Macro is Dead, Long Live Macro

Things have changed... housing looks precarious in the global front.

I spent a large number of years not understanding what "The King is dead, long live the King" meant. Only a few weeks ago with the passing of Queen Elizabeth did i grok what it meant when I heard "The Queen is dead, long live the King". The passing of one state of the world handing power over to the next reminds me of the current state of the world with respect to the economy.

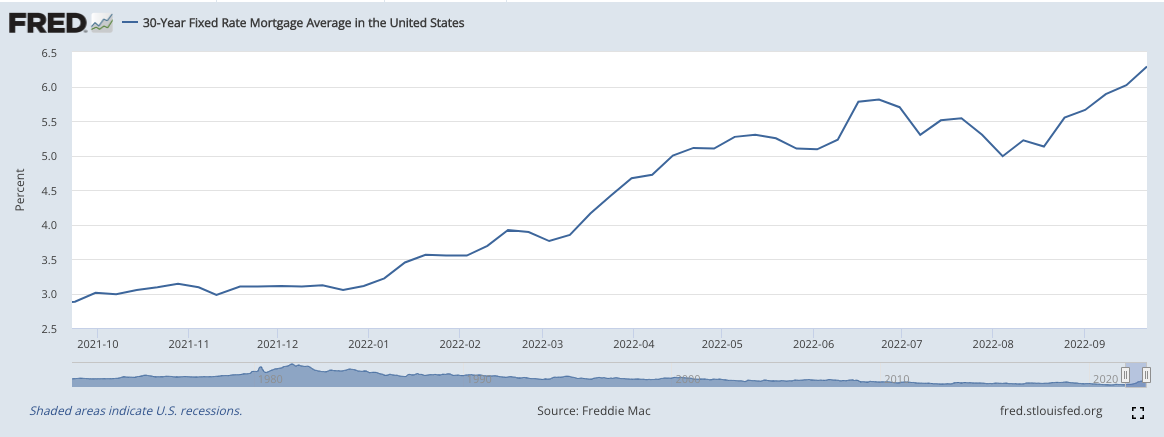

We have shifted recently to a world of inflation and raising interest rates that is happening at a faster clip than I think most expected. The fed has raised rates at .75% for a few times and is causing turmoil in the market. With that increase, the mortgage rates have ballooned up with it.

Using my anecdotal experience in my local market, the monthly payment to own a home has ballooned up. With increasing prices and increasing mortgage rates a home that could have been bought in 2020 for $400k at 3% would cost $1,350. That same house today would probably cost $500k and the rate would be 6.5%, putting the monthly payment at $2,500. This is an 85% increase in monthly payments.

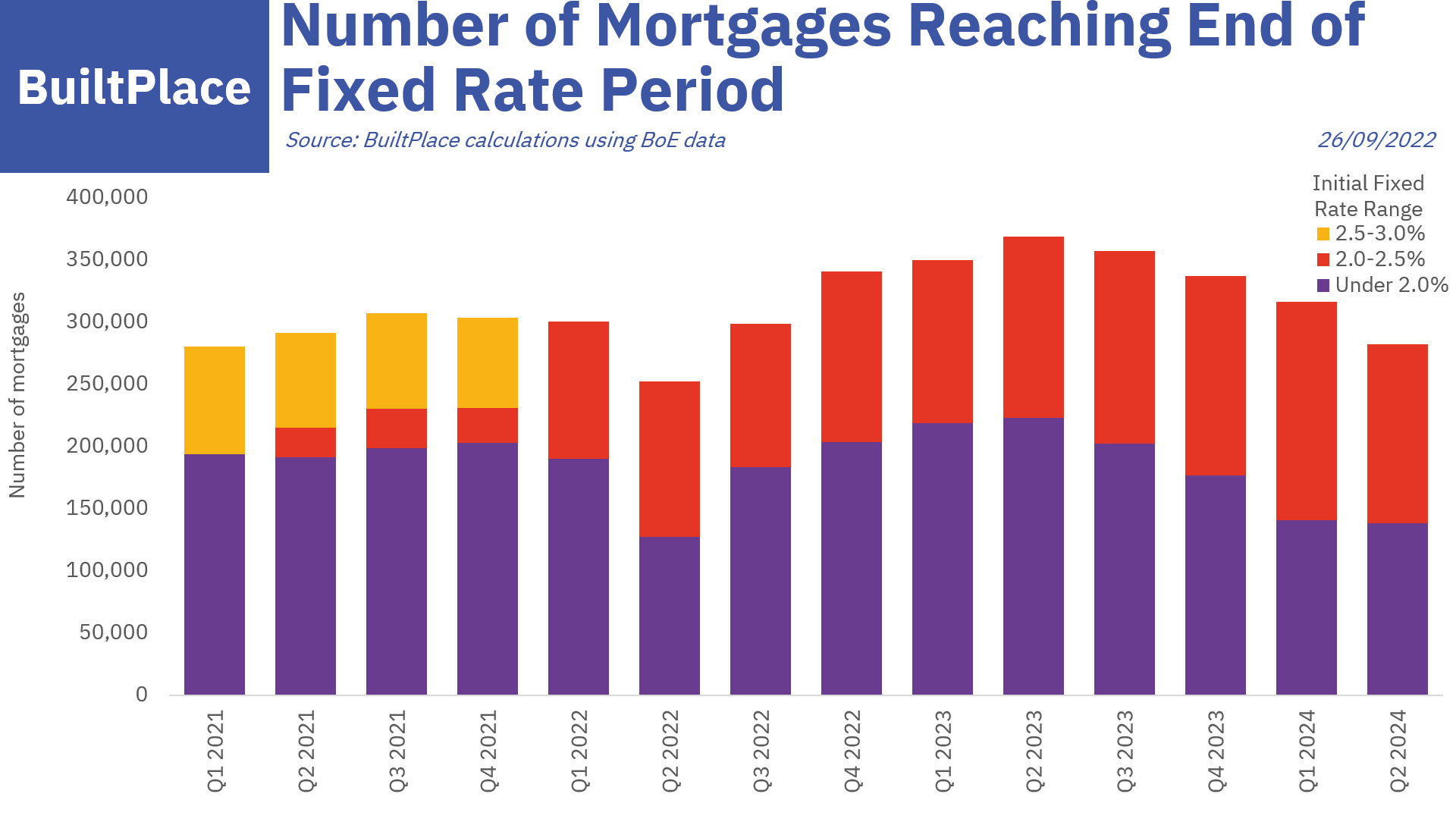

In the US, most mortgages are locked in at a fixed rate for 30 years. However, in other countries, mortgages usually have a short fixed rate that is reset after 5 years or so. If rates don't come down, these home owners are going to get rekt. It is reminiscent of the 2008 mortgage mess where buyers used short term ARM loans to get into a house and couldn't handle the payment resets that came later.

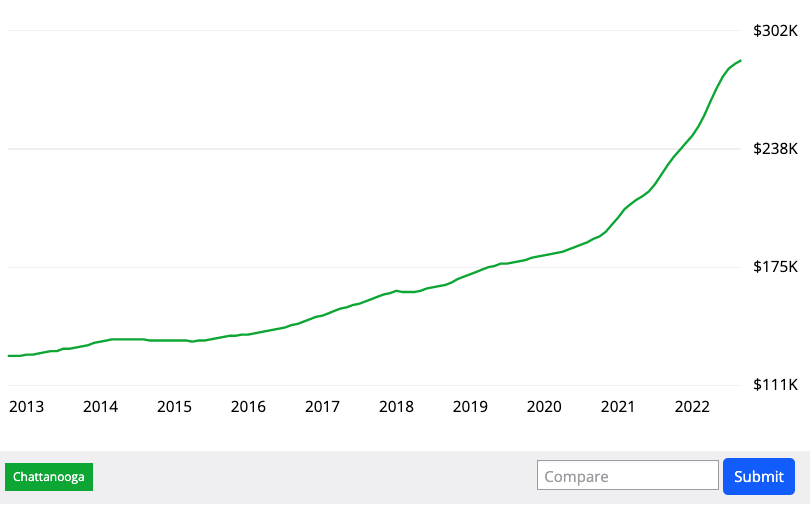

A recent podcast I listened to with a housing analyst had a view that rising interest rates don't actually impact the housing prices until about a year after the change happens. This means that next summer in 2023, the impacts of these changes will be felt. According to this view, prices will need to come down and the market will slow dramatically.

Locally in my market, the demand is still strong, mostly due to lower prices compared to elsewhere in the country, but the higher monthly payments may cause trouble relative to wages in the near future.

In my opinion we have entered into a new era where I am not sure we can expect prices in housing to just continue raising at the rates we may have grown accustomed to. People stretching to buy houses right now may be taking higher risk than they assume and I am planning to sit tight and monitor what happens going into next year. The last housing crash I went through had opportunities to buy houses at a 50% discount but I didn't take advantage of that. Maybe this time I will, but no matter what I think we are in a different world than the last few years.