Weekly Ways to Earn Crypto: yearn.finance

This series has one goal: To make money. In the pursuit of making money, however, there are two approaches. First, you can spend time (labor) to earn money by performing tasks for others. Second, you can utilize cash (capital) to allow it to earn for you. This second approach is the goal. Use money to make money.

This week, I am diving a little deeper into the degeneracy than usual. Yearn Finance is a newish product that has gone from a one man show to an entire community and a governance token with a market cap of $400 million in just a few months.

In addition to this being a new project, it has also not been formally security audited by a paid service (though it has had community sourced audits)... so let's just say: play with this one at your own risk.

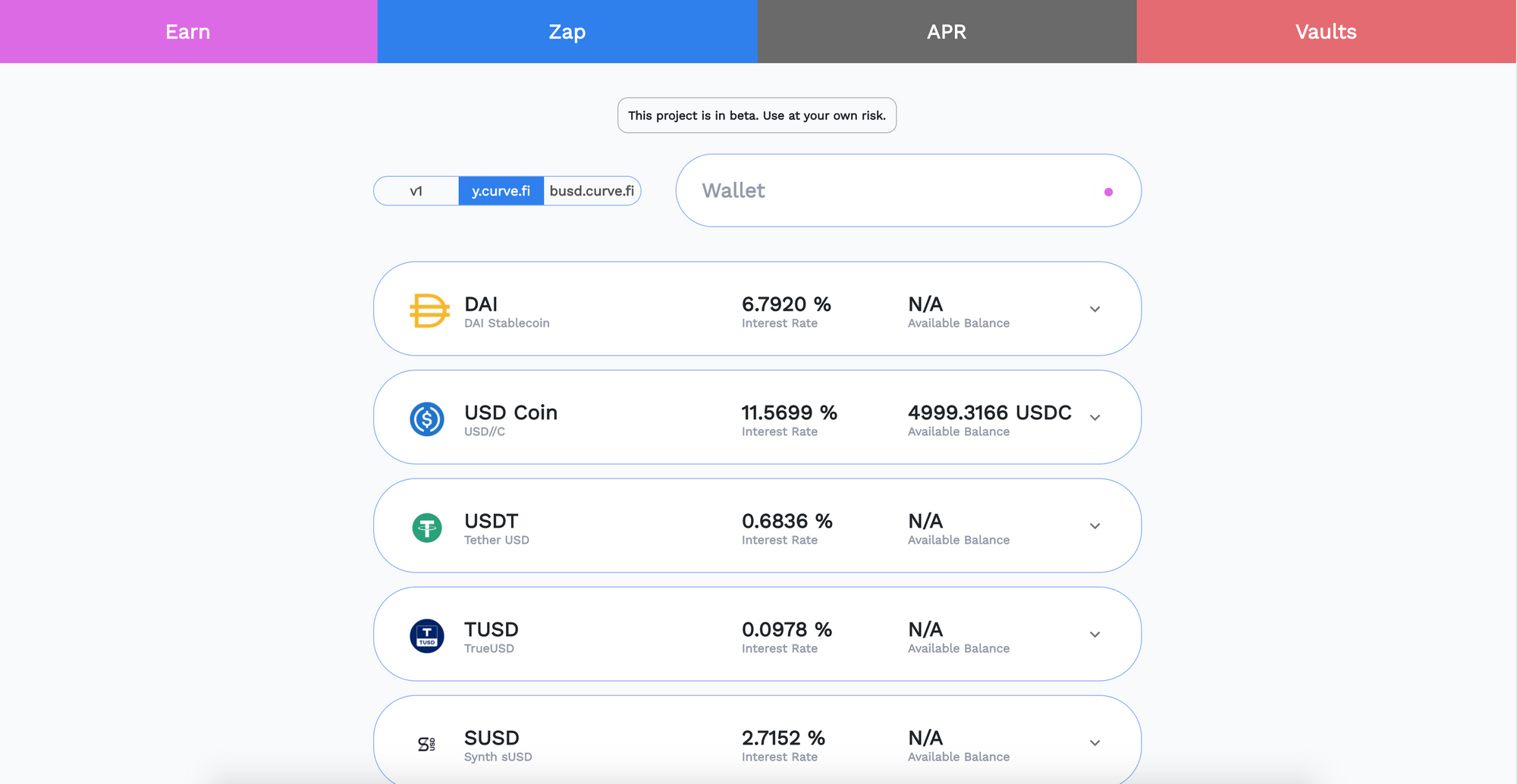

At the basic level of yearn, you can view the "Earn" tab. This is the automated stable coin pool that is supposed to auto rebalance between Compound, Aave, and dYdX lending protocols to maximize your returns.

You can see below that depositing USDC would yield 11.5% at this point in time.

Depositing stable coins into this pool gives you back on ownership "y" token. So if I deposit USDC, I would get back a yUSDC token that I can use to claim my USDC back, plus interest, in the future.

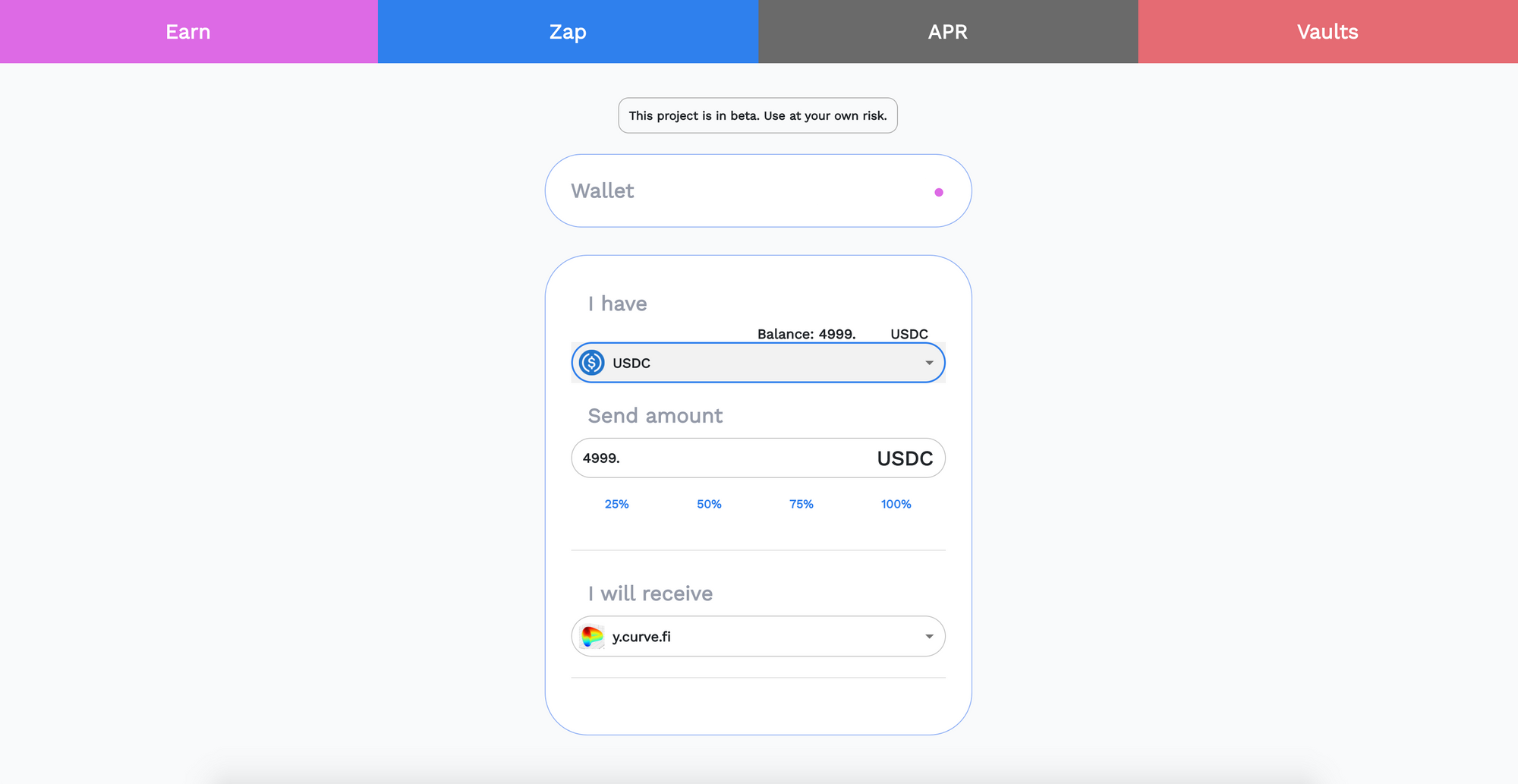

Adding another layer on top of this is the Zap option. There is a pool in Curve that allows you to stake your "y" tokens to be traded as stable coins, where you can earn trading fees. This Zap is supposed to automate depositing the stable coin and sending it into the Curve pool. This is double dipping... what the kids call "Yield Farming".

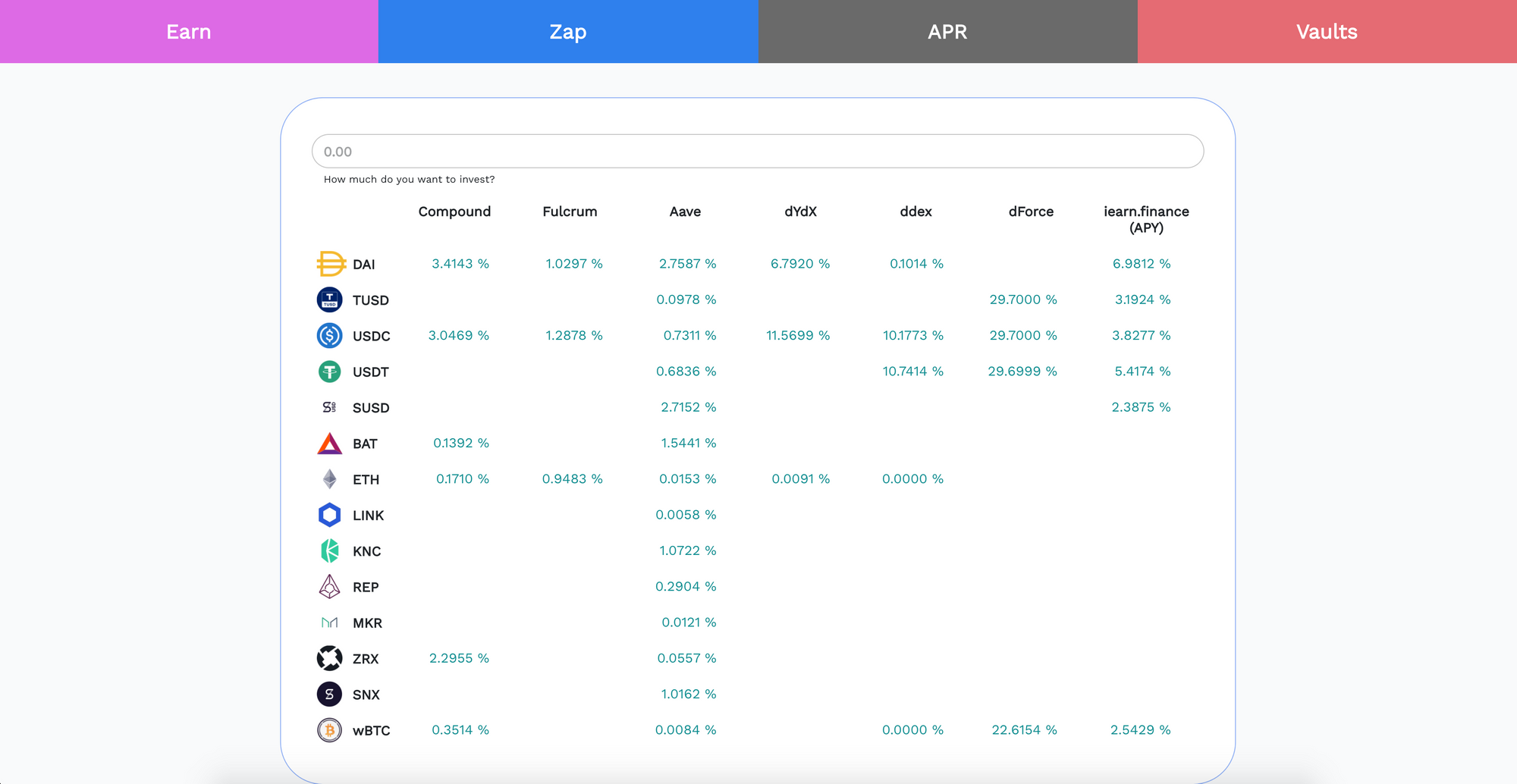

On the "APR" tab in the website, you can see all the current rates for the lending pools. Note that even ones that aren't supported anymore are shown.

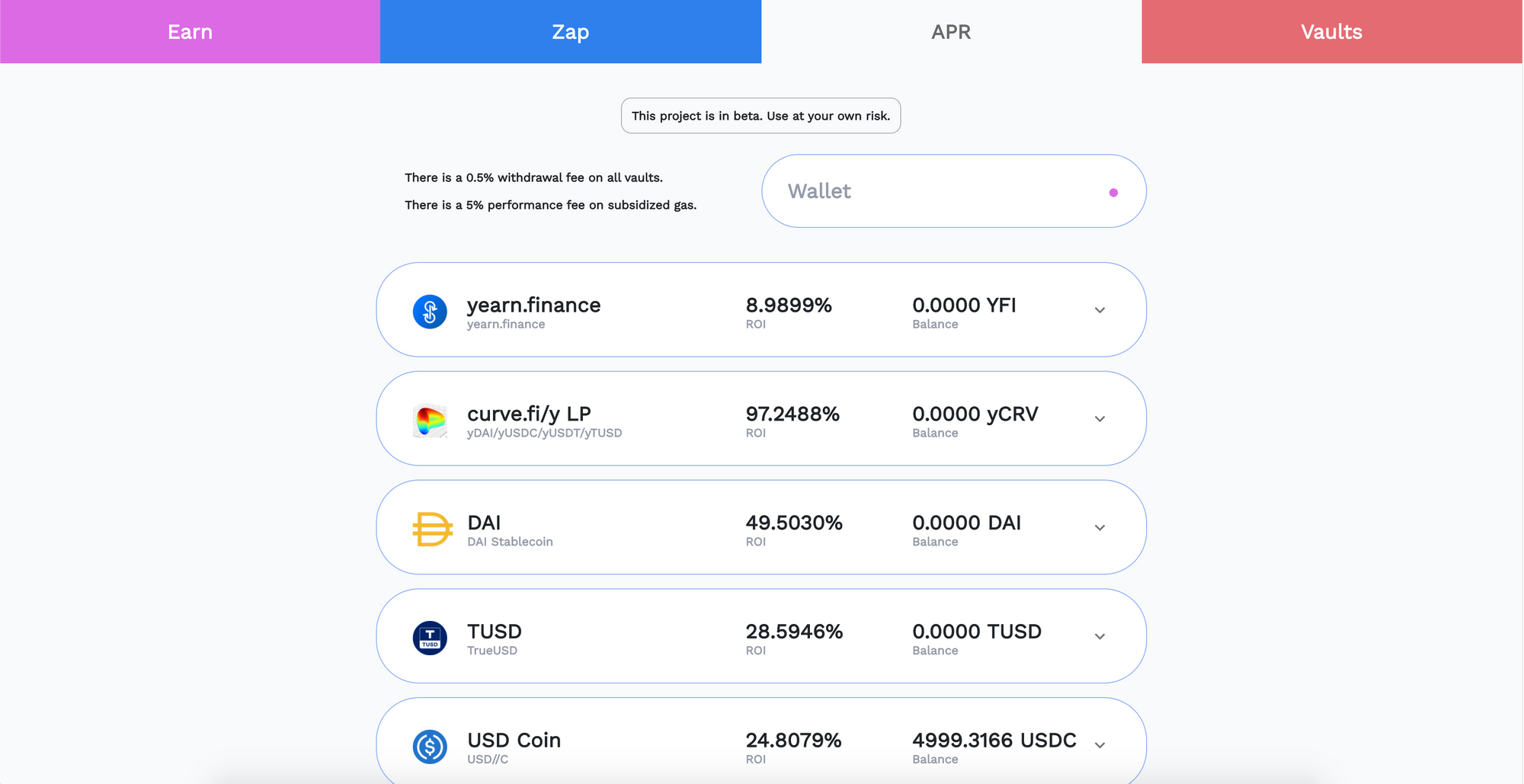

Finally, if you drop into the "Vaults" tab, you can see the latest feature that they have created for yearn.finance. The Vaults are "semi-managed" pools of capital that can be used to goose the earnings even more. When funds are earned for you, the protocol will take a cut and give it to the yearn governance pool. ( This is why the market cap on the token is $400m.). Also, when you withdraw your funds, you will also pay a half percent fee there as well.

Just a note that I am staying away from the Vaults for now. I don't like the idea that someone could theoretically do something stupid with the money and scam everyone or lose it. On top of this risk, it is charging fees and I haven't seen any way to model how much this could be. Theoretically the Vault can go into debt as well.

Back to what I am doing today... I am going to:

- Deposit USDC and get back yUSDC to earn lending fees

- Deposit that yUSDC into the Curve pool to earn trading fees

- Stake the Curve pool ownership tokens to farm Curve governance tokens

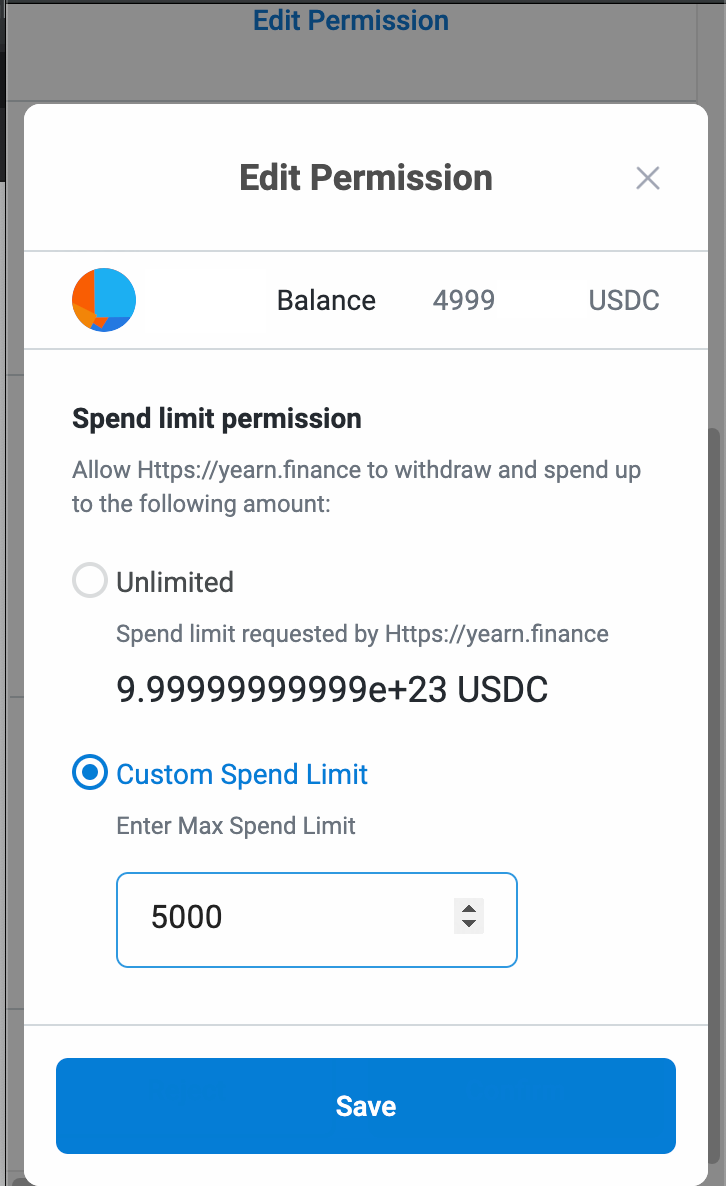

The first problem I ran into is that there is no action button on the yearn.finance site to trigger the Zap. I am assuming this is an older feature that has been disabled. It was originally written by the Zapper.fi team, so I went over there and found the Zap to do what I wanted.

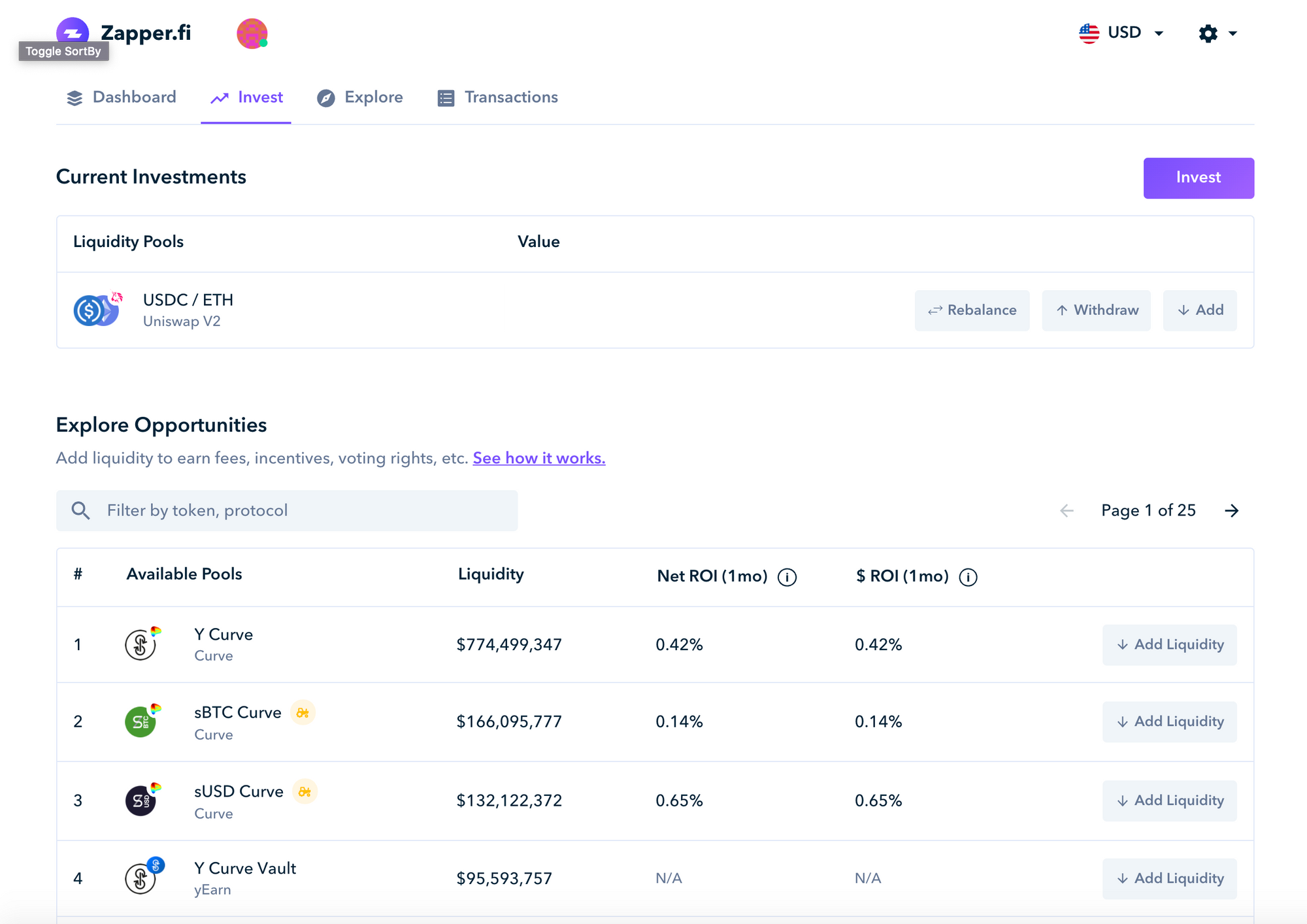

I chose to add liquidity to the Y Curve pool

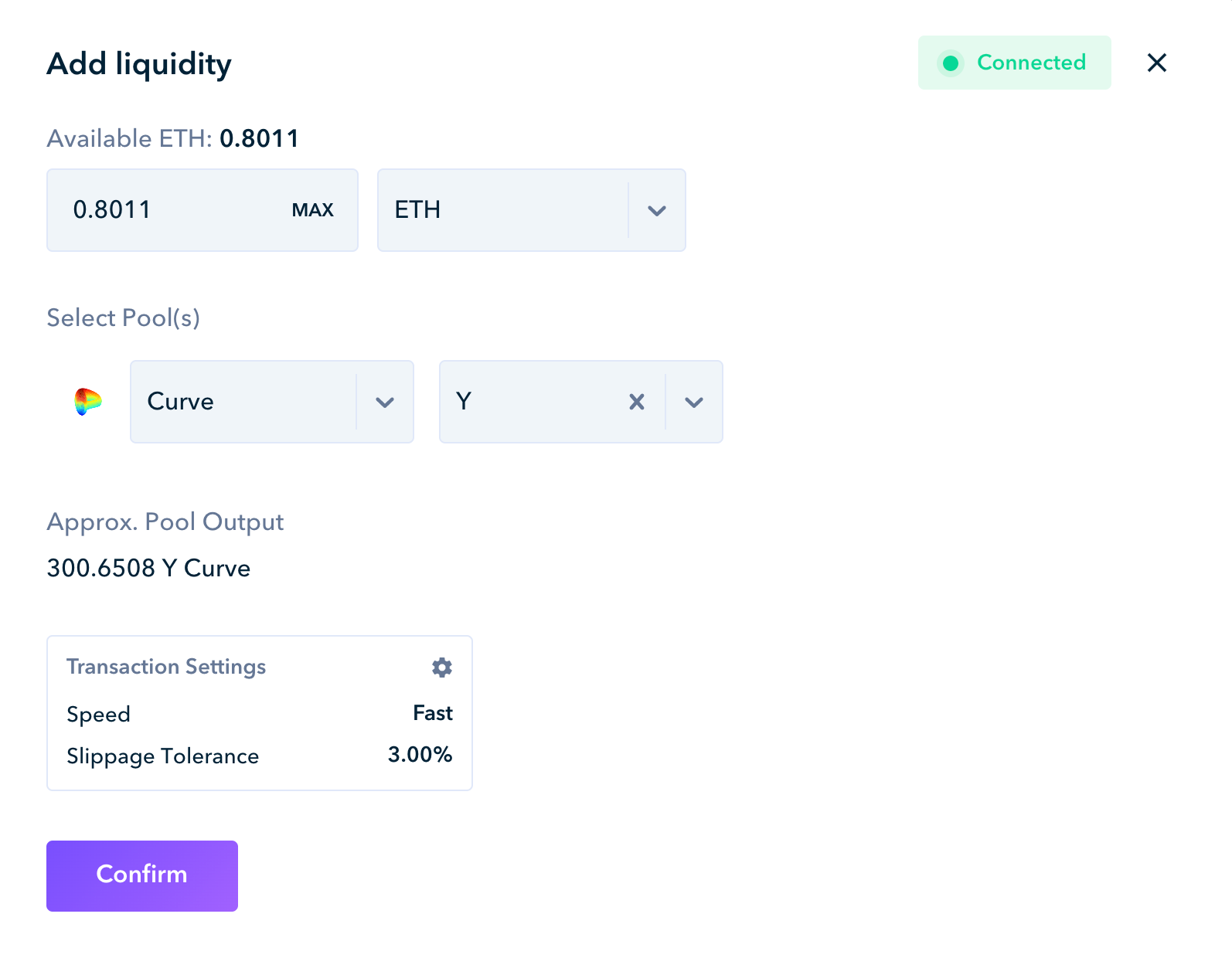

As a test, I checked out how much it would charge to deposit the ETH in my wallet.

$45 worth of gas... If I am depositing $5,000 of USDC, I need to earn back at least 1% to cover this.

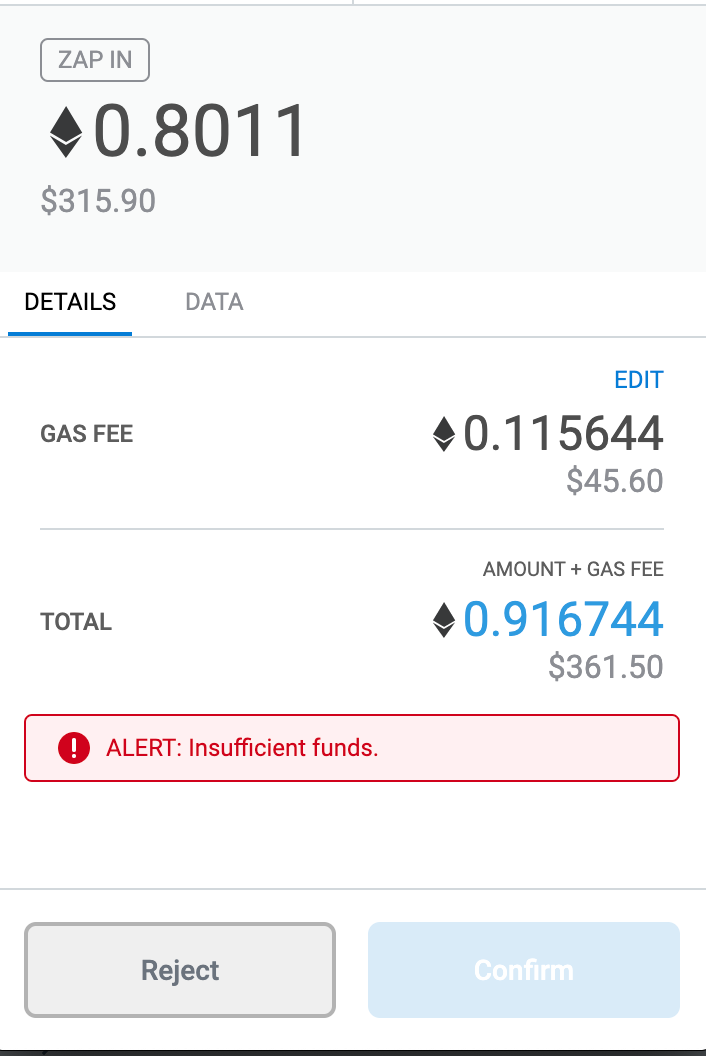

Next I chose to deposit the USDC. Note that I chose to limit how much the Zap contract could move on my behalf.

Once the approval transaction and the zap transaction were done, it showed I had $4,991 worth of Y Curve tokens.

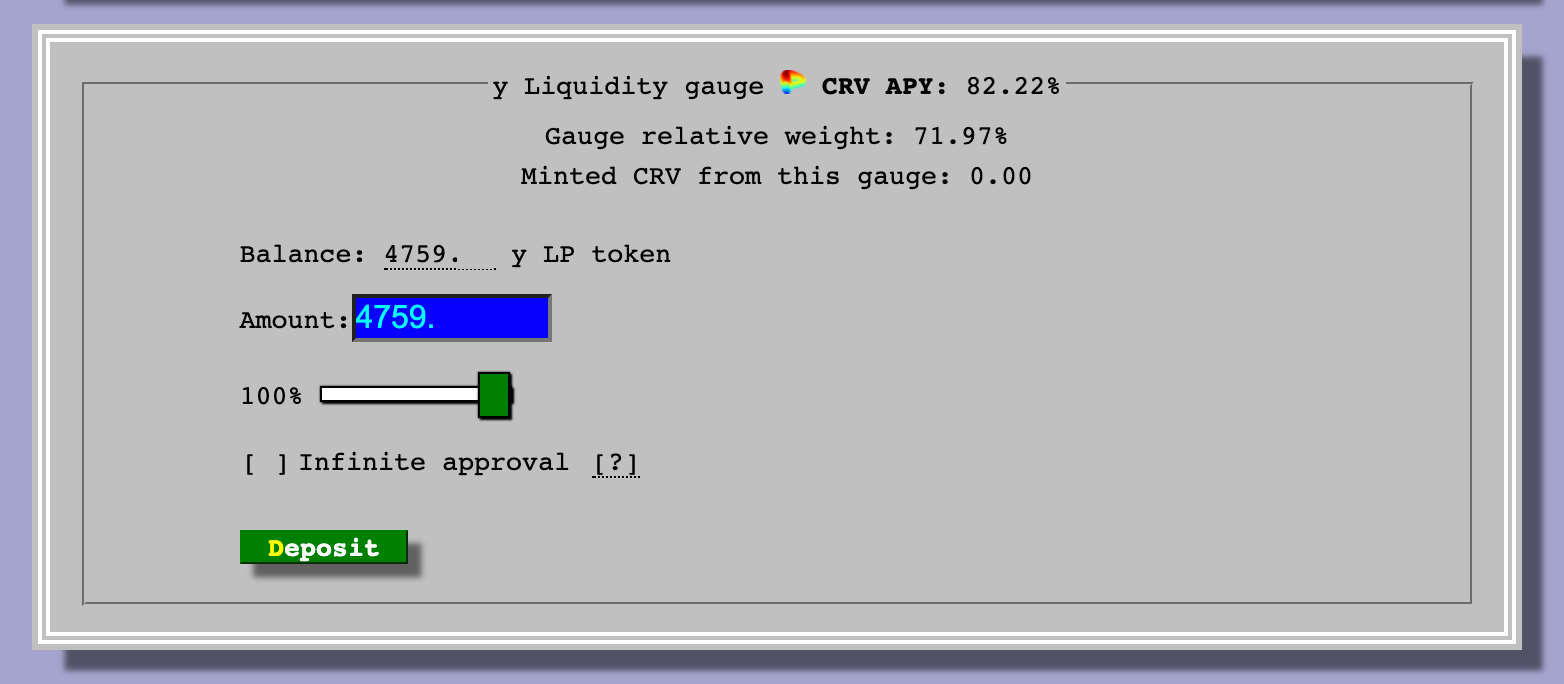

In the next step, I went to Curve and went to the DAO page. There is a section called "y Liquidity Gauge". They call the staking pools "gauges" and this is how you stake pool ownership tokens to get rewarded with Curve governance tokens.

I chose to stake my full amount of approx 4,795 tokens.

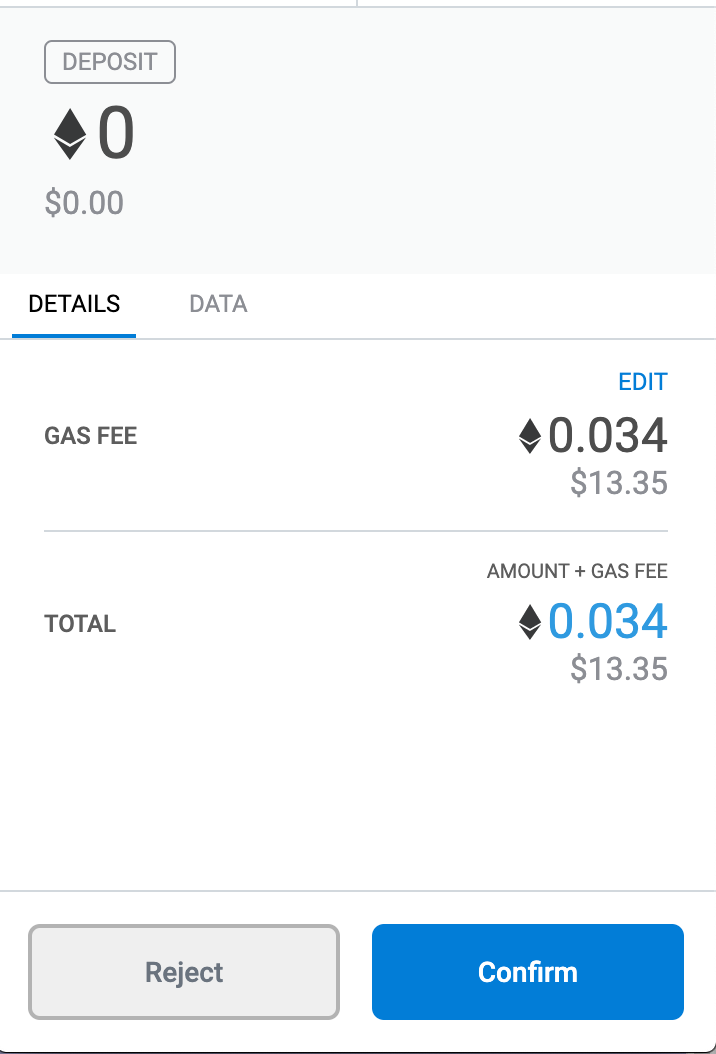

The gas cost was $13 to stake.

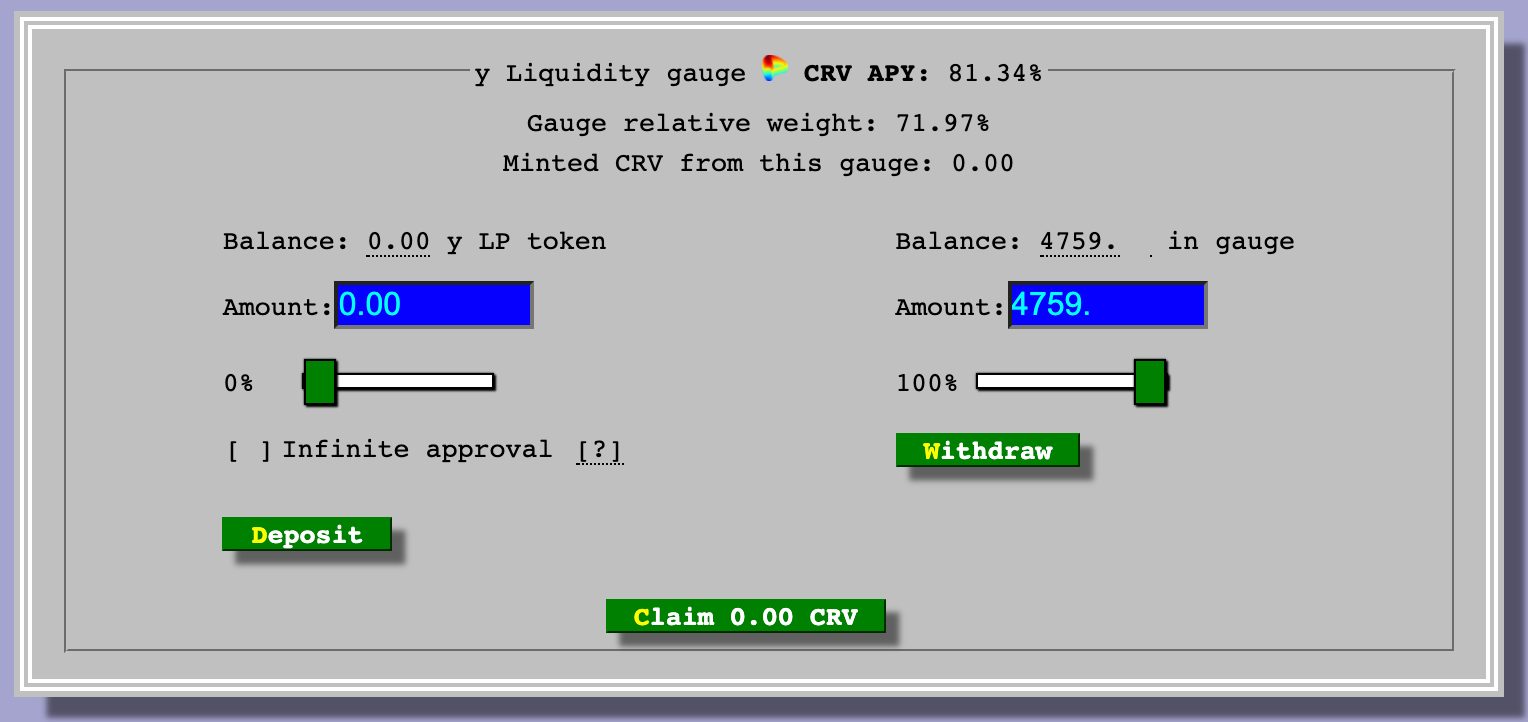

After staking, it shows my current balance in the gauge.

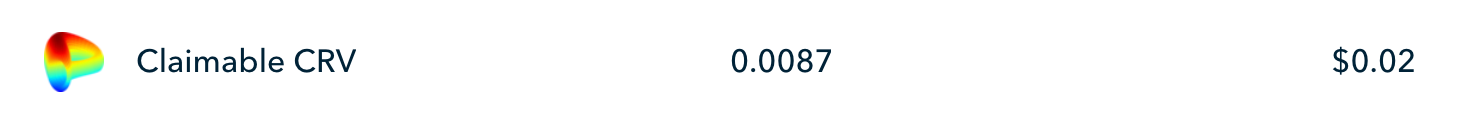

On Zapper.fi I can already see my claimable CRV tokens growing.

To recap, I am making a return by doing the following

- Depositing $5k of USDC into the yearn.finance stable coin pool that will auto rebalance among the 3 lending pools and earn a yield.

- Depositing the yUSDC ownership pool tokens into the Curve trading pool to generate trading fees.

- Staking my Curve y token ownership tokens into the Curve governance DAO to earn governance CRV tokens.

The Trade by the Numbers

- $5,000 USDC from Coinbase

- $0.68 fee to withdraw from Coinbase

- $24.48 ETH transaction fee to Zap into yearn and deposit the yTokens to Curve

- $1.20 ETH transaction fee to approve the Curve Dao staking

- $6.08 to stake into the Curve Governance

Zapper.fi currently tells me my yCurve pool is worth $4,995.21 and I have earned $0.22 in CRV.

This will be a fun one to watch!