Weekly Ways to Earn Crypto: Compound Finance

This series has one goal: To make money. In the pursuit of making money, however, there are two approaches. First, you can spend time (labor) to earn money by performing tasks for others. Second, you can utilize cash (capital) to allow it to earn for you. This second approach is the goal. Use money to make money.

A project that has been getting lot of attention lately is Compound Finance. They just launched their governance token, and have drawn a lot of usage since they are providing rewards of their new token via "liquidity farming" when you use their system. This has drawn a lot of usage and also skewed the rewards for borrowing and selling, so we are going to dive in here and join the party.

Read more about the craziness happening right now here.

For a little bit of background, Compound Finance is a decentralized app that allows users to borrow or lend certain ERC20 tokens on Ethereum.

To lend, you lock some of your tokens into the protocol, and you are given "cTokens" that are generated by the protocol. Over time, these cTokens entitle you to claim a larger share of the liquidity pool based on the interest rate you earn by supplying assets to the protocol.

To borrow, you must first lock tokens into the protocol, and then you can borrow a percentage of that value in another token. The longer you take to repay the tokens back the the protocol, the more you will have to repay to be able to unlock your collateral you put into the app.

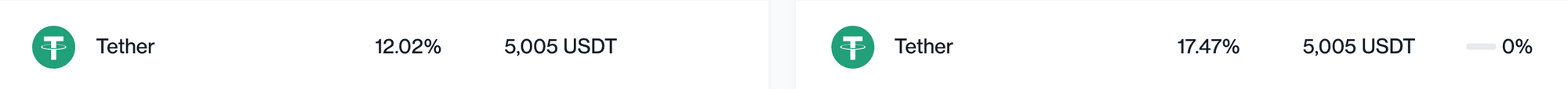

So each asset has a supply rate and a borrow rate. We are going to track how much one can earn by supplying USDT (USD Tether) to the protocol since the

First though, we must jump through a couple of hoops. To get USDT into the protocol we must first buy USDT. Below are the steps I went through...

First, I bought USDC tokens on Coinbase. You can buy and redeem small amounts of USDC with $0 fees, so this is a good onramp into crypto. I submitted a deposit for $5k and waited the 3-5 business days.

Next, I converted it to USDC and withdrew it to an external ETH account.

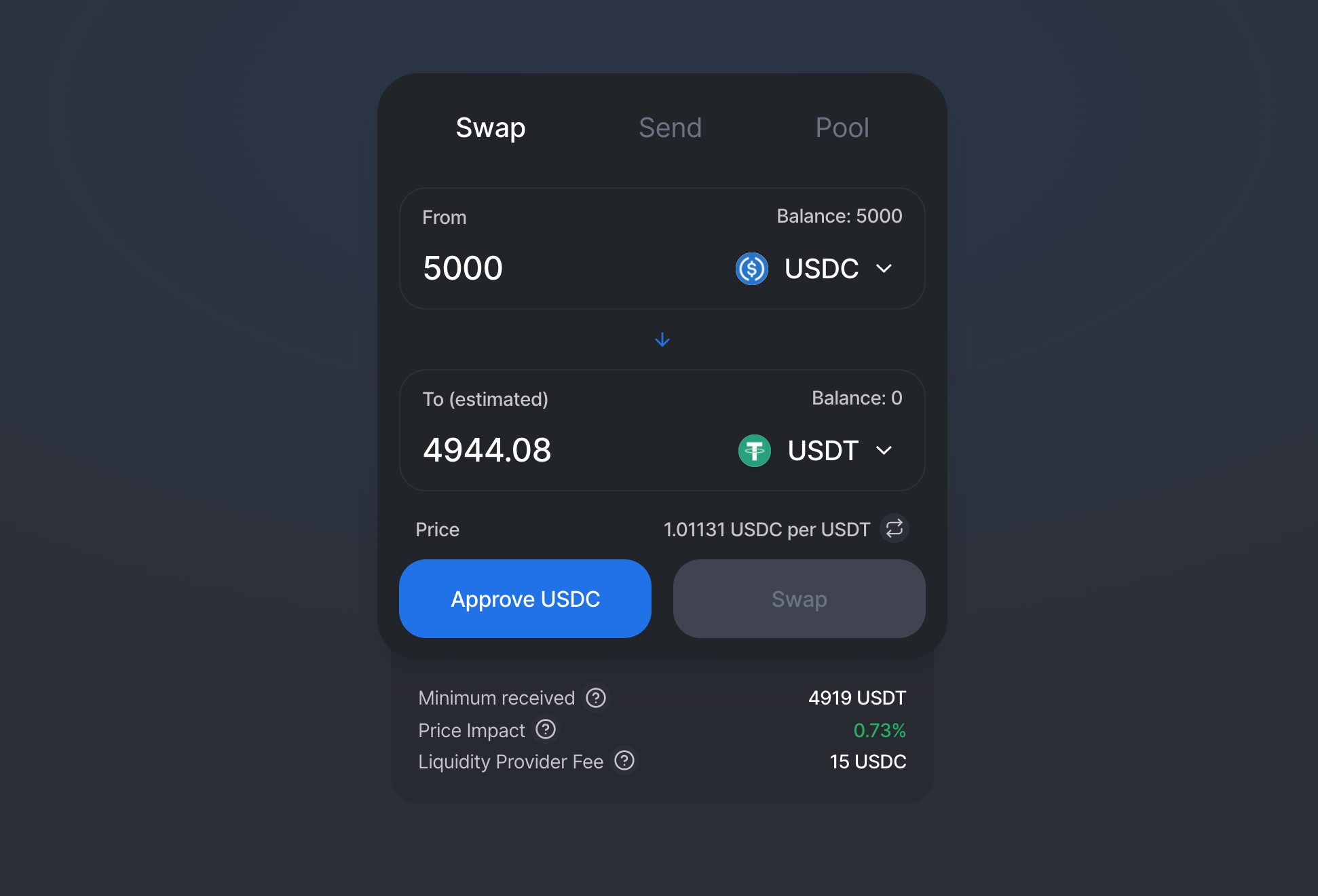

The next step was converting the USDC to USDT. I poked around and first checked Uniswap. Here I plugged in the $5k of USDC to see how many USDT tokens I would get. It showed 4,944 as expected.

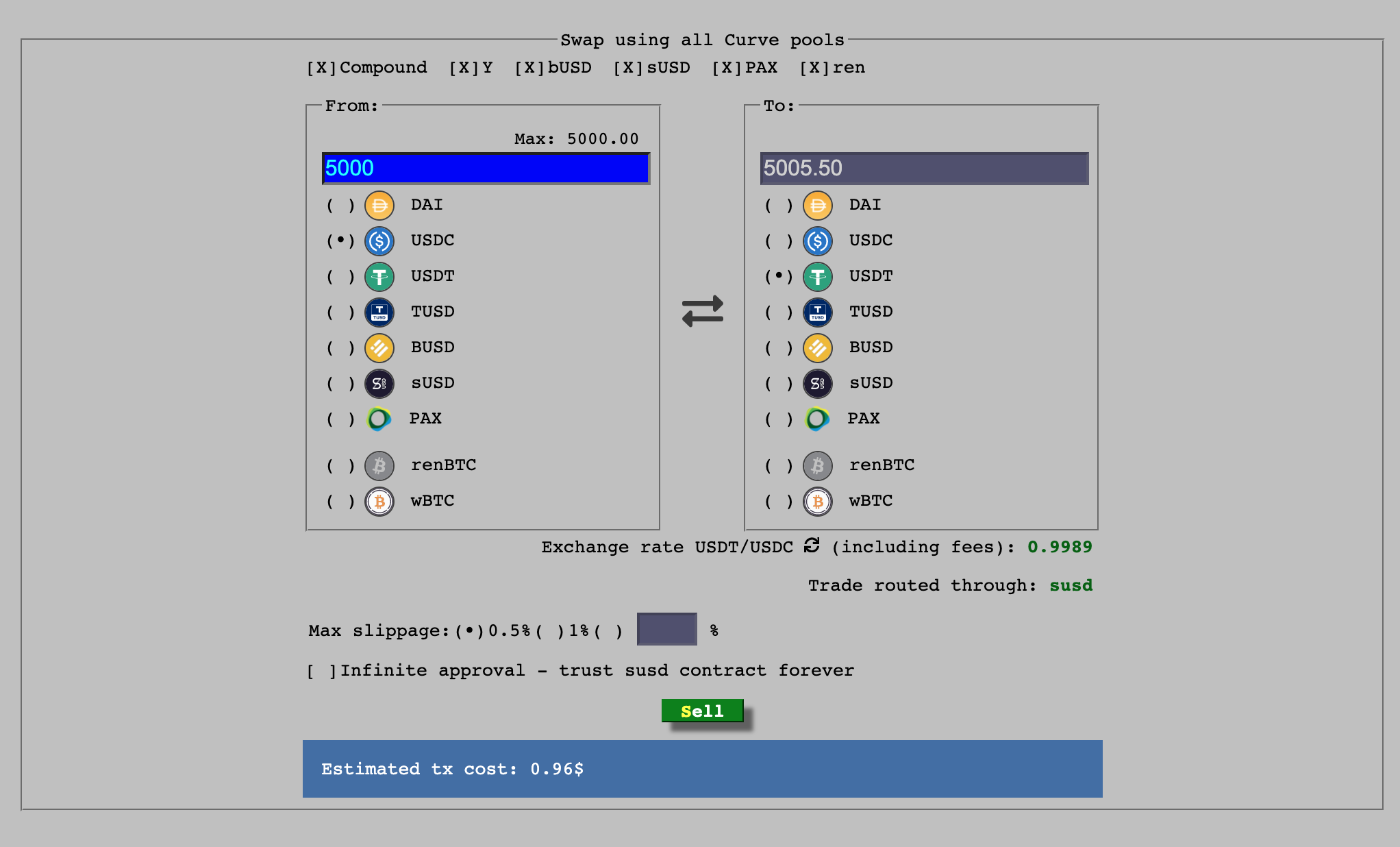

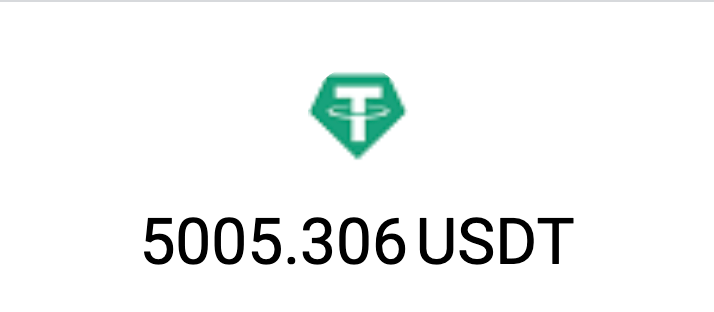

I had read about Curve, and was curious what it would show. It is a liquidity pool, similar to Uniswap but the underlying mechanics are targeted towards stablecoin trading pairs, so it can be more efficient. When I plugged the numbers in here, it showed I would likely get 5,005 USDT. So I went with this option, obviously.

And we are seeing some high usage on Ethereum right now. As I said, interesting times...

Once the trade was confirmed, my balance was indeed close to the 5,005 USDT it had estimated.

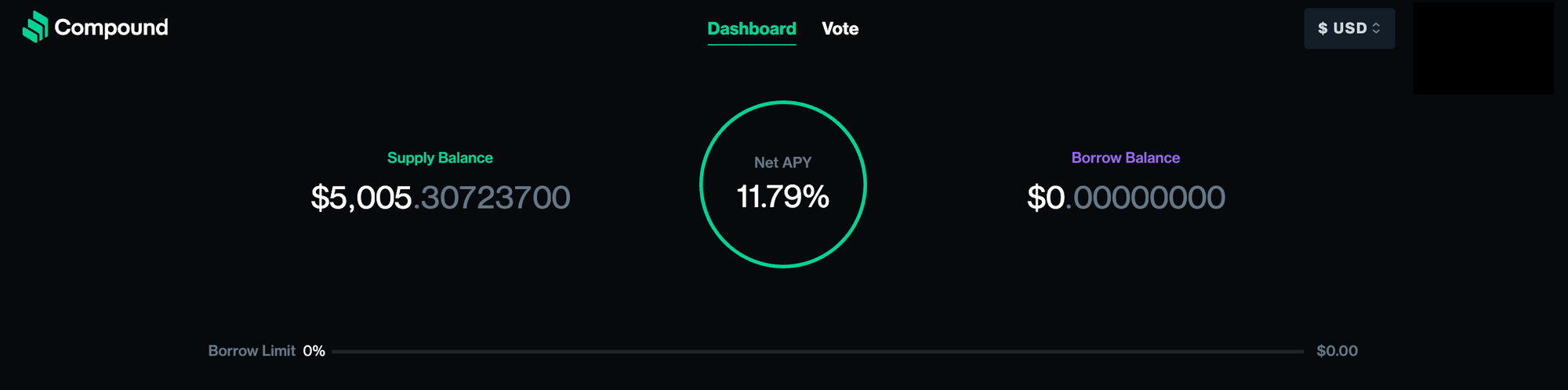

Finally, we go to Compound. Here, I had to first approve the Compound app to move tokens from my wallet into the application. Second I had to trigger the supply call to move the USDT. Once that was all said and done, the assets show up in my supply balance and show it is currently earning 11%.

To accomplish all this, I had to perform 5 transactions on the Ethereum protocol. The first was from Coinbase, which was free. The next two were to approve and trade on Curve. The final two were to approve deposit on Compound and supply the tokens. The five transactions cost approximately $2.58.

The total cost of this strategy of supplying $5k in USDT to Compound was $5,002.58. This will be the cost basis going forward and we will track the gains/losses.

| Date Started | Item | Cost | Current Value | Gain/Loss | Percentage |

|---|---|---|---|---|---|

| 6/13/2020 | Buy Bitcoin | $5,012.80 | $4,936.75 | -$76.05 | -1.52% |

| 6/15/20 | TokenSets | $5,007.55 | $4,856.54 | -$151.01 | -3.02% |

| 6/18/20 | Compound | $5,002.58 | $5,011.78 | $9.20 | 0.18% |

Totals -$227.06 -2.27%