Weekly Ways to Earn Crypto: Selling Bitcoin Options

This series has one goal: To make money. In the pursuit of making money, however, there are two approaches. First, you can spend time (labor) to earn money by performing tasks for others. Second, you can utilize cash (capital) to allow it to earn for you. This second approach is the goal. Use money to make money.

This one may be a little more complex for the noob crypto traders out there. The idea is this: Earn some money today for giving up a large upside in the future. And we're going to be selling some Covered Call Option Contracts.

If you don't understand how options work, go read the wikipedia page. No need to recreate all that info here. The main point is that we want to generate a return on some Bitcoin that we are hodling. If the price skyrockets, we'll lose out on a bit of the upside as a tradeoff.

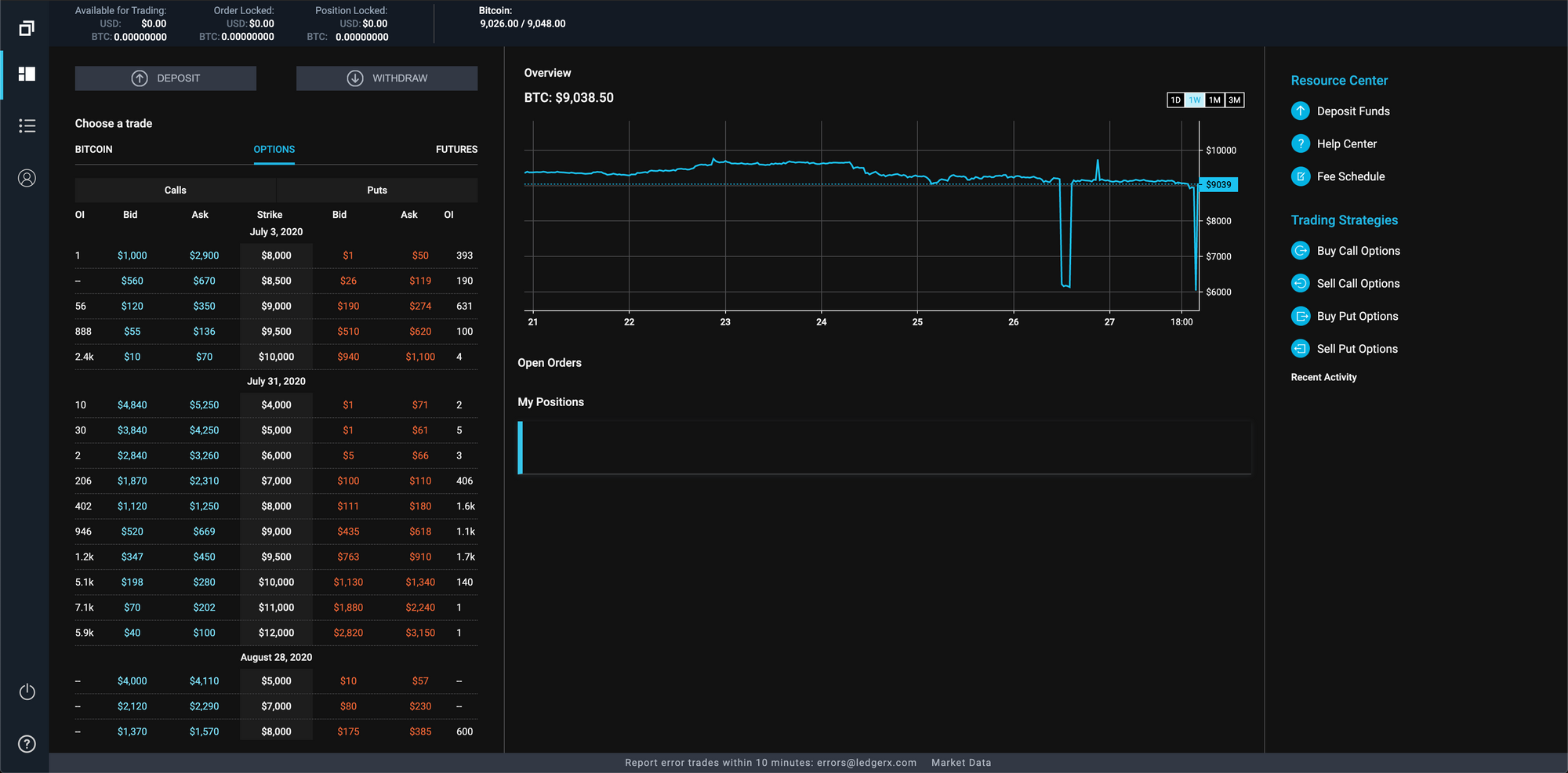

The LedgerX Omni app is what I've been using for testing options trading. Once you get access to the dashboard, you'll see the order book on the left, your activity in the middle, and resources on the right.

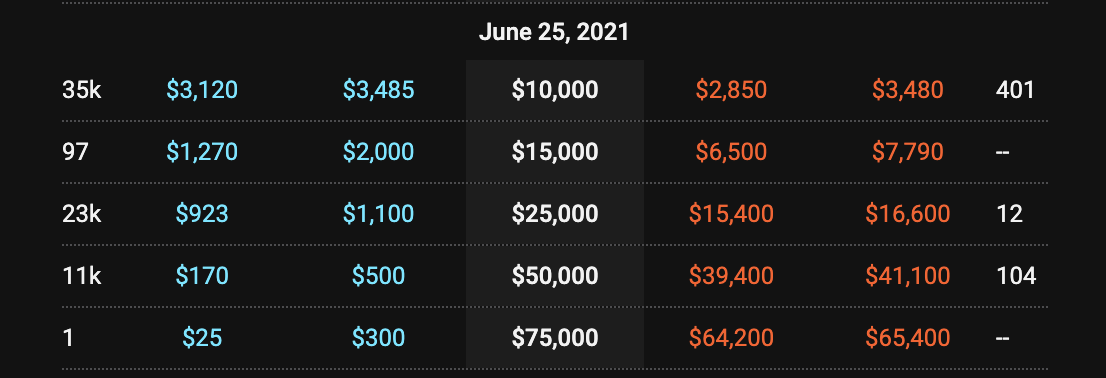

For this experiment, we will be using a 1 year option contract, expiring in Jun 2021 at a strike price of $25k. On June 25th 2021, if the price of BTC is below $25k I get my Bitcoin back and keep the premium, but if the price is over $25k, I sell my Bitcoin for a $25k price to the purchaser of the option. I will consider both outcomes a WIN.

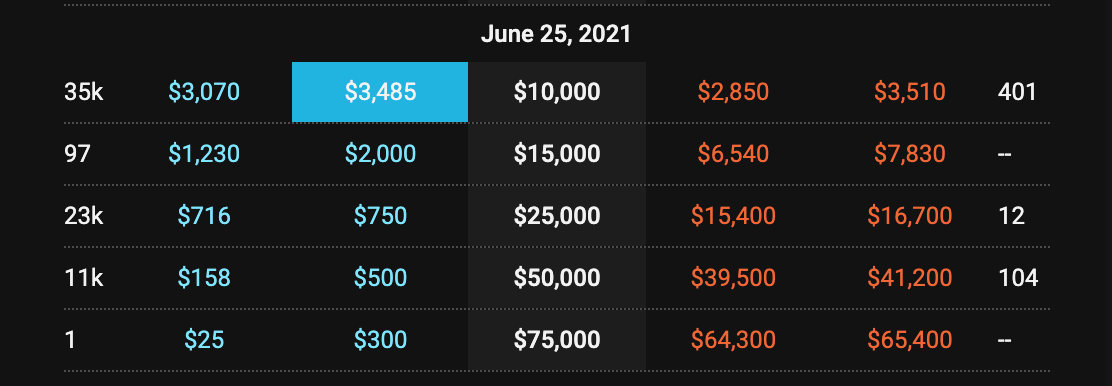

The order book shows that there are bids and asks for Call Options on the left side of the graphic.

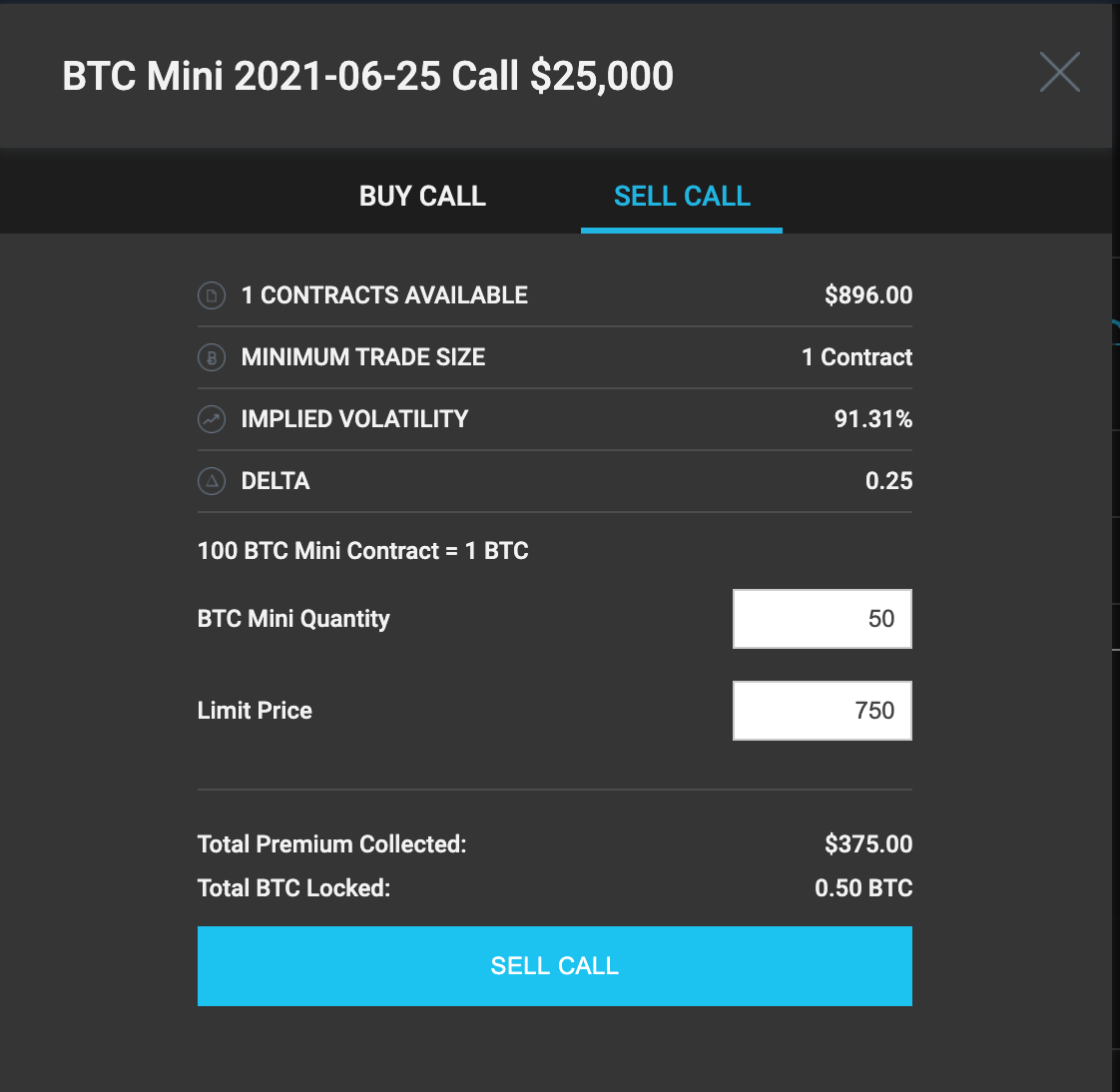

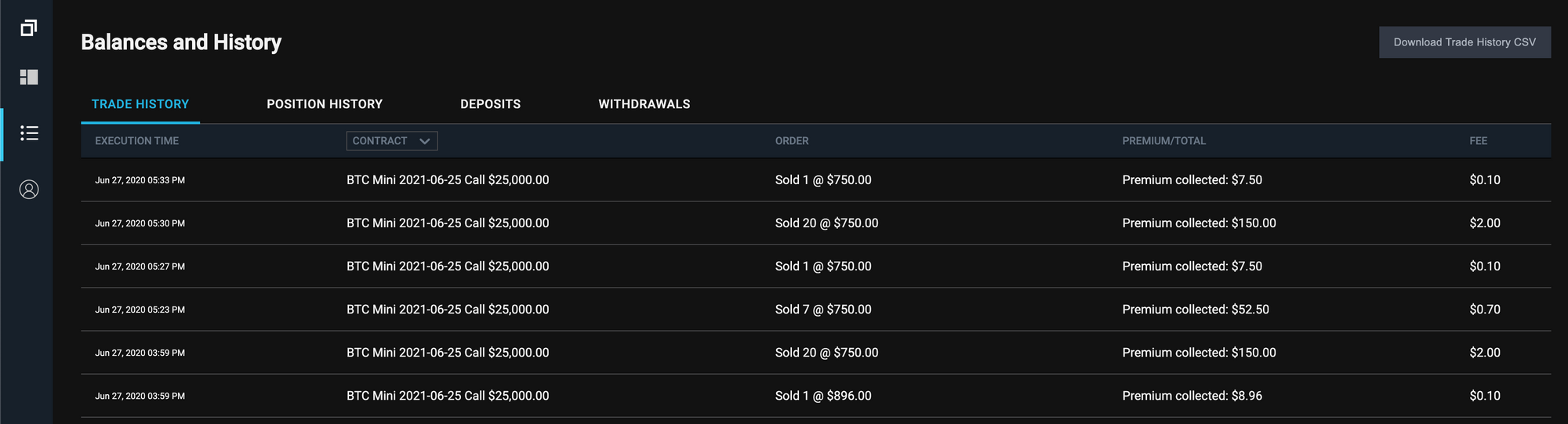

To place the sell order, just click the strike price and fill out the details. We are going to be trying to hit around $5k, so I hit 50 mini contracts for 0.5 BTC and put in a limit price of $750. (mini contracts are 1/100th of a bitcoin)

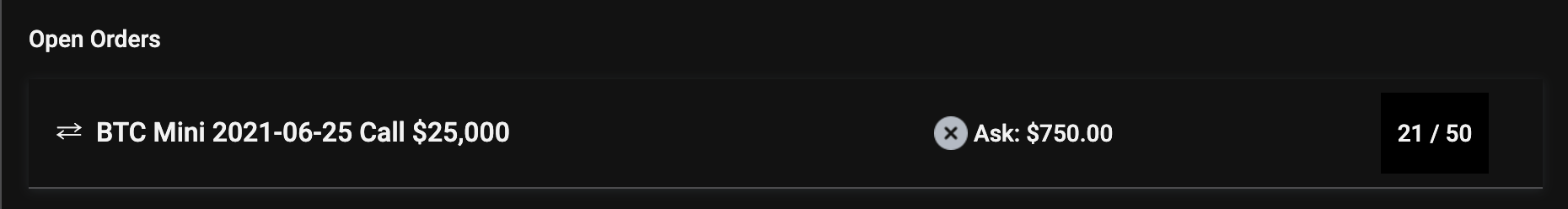

The order was opened and waiting for someone to come purchase it. After a while, someone purchased about half of the order.

While it was in the partial fill state, you can see the $750 sell order on the book on the $25,000 row.

By the end of the day, all the order was completely filled and the USD was in my account.

Cost: $4,500

Fees: $5.00

Premium collected after fees: $371.46

For the numbers, the Bitcoin USD equivalent I locked up was around $4,500 at the time. This generated $371, bringing the initial return to around 8%.

So when would you want to use this strategy? I like to think of it as beneficial to people who know they want to hold Bitcoin for the long term, but wouldn't mind selling some if the price had a huge rally. You get compensated for limiting your upside and generate a decent return on an asset that would otherwise be sitting dormant.

Re-Calculated 07-17-2020

| Date Started | Item | Cost | Current Value | Gain/Loss | Percentage |

| 6/13/2020 | Bitcoin | $5,012.80 | $4,856.69 | -$156.11 | -3.11% |

| 6/15/20 | TokenSets | $5,007.55 | $4,646.28 | -$361.27 | -7.21% |

| 6/18/20 | Compound | $5,002.58 | $5,020.98 | $18.40 | 0.37% |

| 6/27/20 | LedgerX | $4,500.00 | $4,949.96 | $449.96 | 10.00% |

Totals -$49.02 -0.25%